Ethos Index Universal Life Insurance (IUL)

from Ameritas Life Insurance Corp.

When you think of life insurance, it’s natural to think of your loved ones. With Ethos IUL, you’ll also find out how much life insurance can offer you:

A cash value and living benefits for times of challenge or opportunity.

Valuable tax advantages. Market-based growth without market-based loss.

Even an optional retirement income stream that lasts the rest of your life.

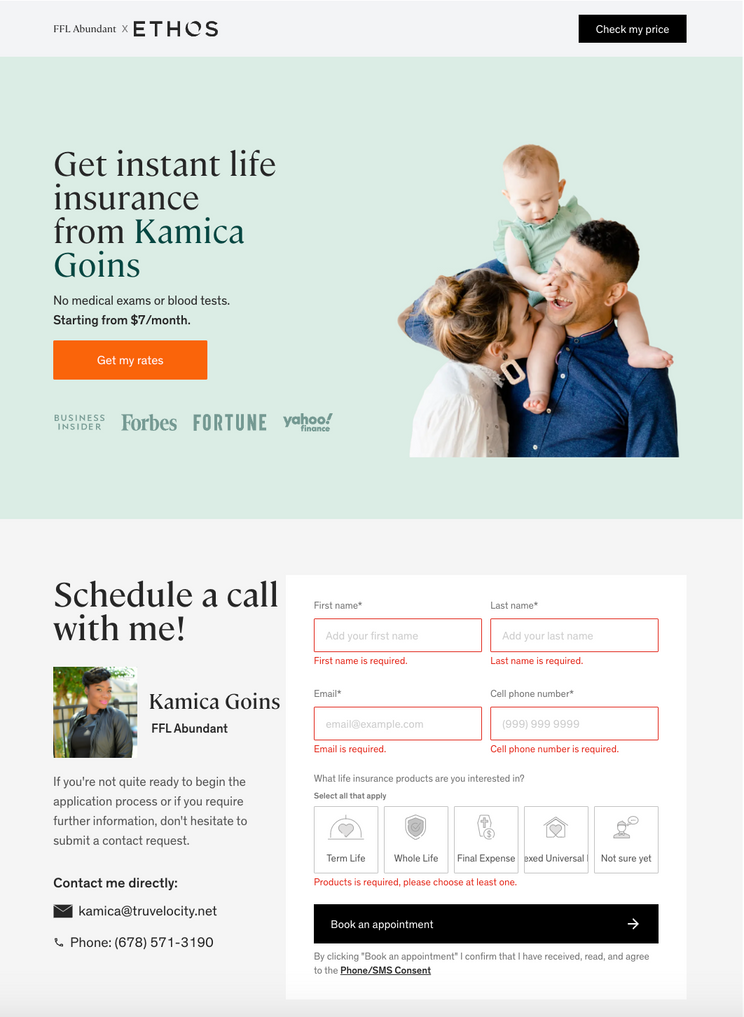

Discover Ethos IUL, a new, hassle-free way to get the life insurance

protection your loved ones need with financial benefits that work for you.

Ethos Index Universal Life Insurance (IUL)

Life Insurance that Protects You in 3 Ways

1. Death benefit protection

Lifelong protection for your family

Ethos IUL is designed to provide life insurance coverage you’ll never outlive. As long as certain premium and cash value requirements are met, your loved ones are guaranteed to receive a tax-free death benefit1.

Financial support if major illness strikes

If you’re diagnosed with a qualifying critical, chronic, or terminal illness, you can access a portion of your death benefit early for medical expenses, your bucket list, or any other purpose.

2. Cash value growth potential

Tax-advantaged accumulation

Increase cash value through fixed account growth or through index options that credit you based on the performance of popular market indexes, up to a maximum. Growth is generally tax-free2.

Zero downside risk

If an index is down, the index option to which it's tracked will never go below 0%—meaning you’ll avoid all market-based losses.

3. A lifetime financial cushion

Liquidity during your working years

Access your policy’s available cash value any time via tax-free policy loans and withdrawals3. Loans and withdrawals affect long-term policy performance.

Retirement income options

Activate the Lifetime Income option for a monthly income that lasts as long as you live. Or tap your policy’s cash value for supplemental retirement income as needed.

1. In general, life insurance death benefits are free from federal income taxes pursuant to the IRS (IRC § 101(a)(1)). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Potential examples include the sale of a life insurance policy, or employer-owned policies. Consult your tax advisor for full details.

2 Cash value growth becomes taxable only if you withdraw more than the total of

premiums paid, or if the policy lapses.

3 Tax-free incomes assumes that 1) withdrawals do not exceed tax basis (generally,

premiums paid less prior withdrawals) and 2) that the policy is not a modified

endowment contract. See IRC §§ 7702(f)(7)(B), 7702A. Loans and withdrawals that

exceed the total premiums paid will also become taxable if a life insurance policy lapses.

2 of 9

Ethos Index Universal Life Insurance (IUL)

Live more, worry less

Discover life insurance that checks more boxes. Compare Ethos IUL to common alternatives.

Limited-time death benefit Lifetime death benefit Cash value growth Tax advantages

Market-based growth with

no downside risk

Flexible premiums

Lifetime income option

Early access to death benefit for

18 qualifying critical, chronic &

terminal illnesses

Instant decision (most cases)

Ethos IUL

✔ ✔ ✔

✔ ✔

✔

✔

✔

Most IUL competitors

✔ ✔ ✔

✔ ✔

Whole life

✔ ✔ ✔

Term life

✔

The speed and simplicity of Ethos IUL

Unlike traditional IUL offerings, the Ethos IUL application process involves no medical exams, blood tests, or weeks and months of underwriting. Simply answer a few health and financial questions with your agent, and our breakthrough technology can provide an instant coverage decision in most cases.

3 of 9

Ethos Index Universal Life Insurance (IUL)

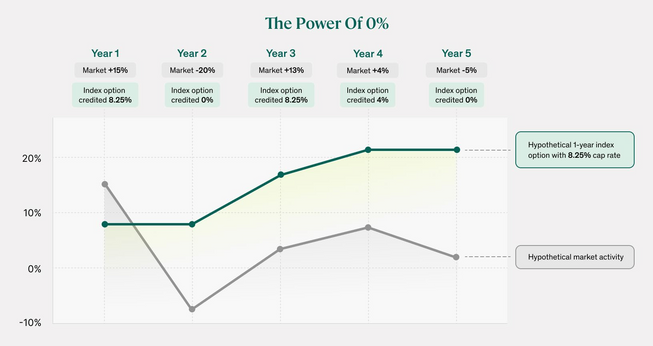

Market-based growth without market risk

Your policy’s available cash value as well as a portion of your new premium can be allocated to Ethos IUL’s index options. These options are tied to the performance of popular market indexes, without any actual market exposure.

How index options work

You may allocate available cash value to any index option you like, for one- or two-year index periods. The percentage change between the beginning and end of an index period is credited to the index option.

For some index options, this credit is subject to a maximum, or cap rate. For other index options, the credit is

multiplied by a participation, or par rate. Cap and par rates can fluctuate, but are guaranteed until the index

period matures.

Available index periods 1 Year, 2 Year

1 Year

1 Year, 2 Year

You can also allocate all or part of your cash value to a fixed account.

Built-in protection against market corrections

Ethos IUL index options feature a 0% minimum crediting rate, or floor, that protects you from market-based loss. Because index options can only step up, they reduce the impact of market volatility over time.

4 of 9

Ethos Index Universal Life Insurance (IUL)

Lifetime liquidity

A financial cushion in your working years

Access your policy’s available cash value anytime through loans and withdrawals, which are generally tax-free1. This can provide financial protection for life’s unexpected emergencies and opportunities—with some important considerations.

Pros

Tax-free money1. As long as the policy is in force,

✔

loans are tax-free and withdrawals are tax-free up to what’s known as your basis—the total of premiums paid, minus any outstanding loans and prior withdrawals.

Fast, flexible and creditor-free. Loans and

✔

✔

withdrawals can be used for any purpose, and the

money can be accessed quickly with no lenders or

credit checks involved.

Attractive loan terms. Fixed account loans

feature low interest rates, while variable loans

allow you to remain allocated to index options.

Things to keep in mind

Loans and withdrawals will reduce your

✔

✔

death benefit and impact cash value growth. Make sure you’re maintaining adequate life insurance protection for your family and keeping your long-term objectives on track.

Excessive and unpaid loans can create

a taxable event. Ethos IUL’s Overloan Protection

Benefit and 20-year No-Lapse Guarantee will

prevent policy lapse if certain requirements are

met. If these requirements are not met, your policy

can lapse, creating a taxable event and loss

of coverage.

Goals for your golden years

Once you retire, Ethos IUL allows you to create an income stream you can never outlive.

Option 1: Activate the Lifetime Income rider.

Convert your cash value into level or increasing monthly payments that last the rest of your life.

•

This option is available between ages 50 and

85 as long as certain conditions are met. There

is a one-time charge based on account value to

activate this benefit.

Option 2: Stay flexible.

Create supplemental retirement income as needed via policy loans and withdrawals.

•

Access the policy’s cash value instead of market-

facing assets during a downturn. This can give

funds with market exposure time to regain value,

and help retirement savings last longer.

Both the Lifetime Income rider and standard policy loans and withdrawals decrease the policy’s cash value and

death benefit over time.

1 Tax-free incomes assumes that 1) withdrawals do not exceed tax basis (generally, premiums paid less prior withdrawals) and 2) that the policy is not a modified endowment contract. See IRC §§ 7702(f)(7)(B), 7702A. Loans and withdrawals that exceed the total premiums paid will also become taxable if a life insurance policy lapses.

5 of 9

Ethos Index Universal Life Insurance (IUL)

Compare financial alternatives

While more than one option may be right for you, take a look at how Ethos IUL compares to some common financial alternatives:

No annual contribution limits8 Tax-advantaged growth Tax-deductible contributions7 Tax-advantaged3 distributions

Fast, easy loans &

withdrawals, generally tax-

free3 Access to tax-free funds2 for

qualifying health conditions

Tax-free death benefit1

Ethos IUL

✔9

✔

✔

✔

✔ ✔

Tax-advantaged retirement accounts4

Taxable investments

Qualified

plans

✔ ✔

Roth IRAs

IRAs

✔ ✔

Variable

annuities

✔ ✔

CDs

(FDIC insured)

✔

✔

Bonds5

✔

Mutual funds6

✔

Income tax treatment includes the treatment of capital gains and dividends. This chart excludes estate tax treatment.

Once, twice, three times tax-advantaged

Ethos IUL offers several important tax benefits:

•

A death benefit for your loved ones that’s generally tax-free1.

• Tax-advantaged3 cash value growth that’s tied to popular indexes. Performance potential

•

can be competitive with taxable financial alternatives.

Access to your cash value via policy loans and withdrawals, which are generally tax-free1.

1 In general, life insurance death benefits are free from federal income taxes pursuant to the IRS (IRC § 101(a)(1)). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Potential examples include the sale of a life insurance policy, overfunding a policy, or employer- owned policies. Consult your tax advisor for full details.

2 Using the Care4Life Accelerated Death Benefit, policyholders may access a percentage of their tax-free death benefit early for qualifying critical, chronic

and terminal health conditions. See page 6 for details. Care4life rider is not a long term care product.

3 Cash value growth is not subject to capital gains and access is tax-free assuming the following: 1) that withdrawals do not exceed tax basis (generally,

premiums paid less prior withdrawals) and 2) that the policy is not a modified endowment contract. See IRC §§ 7702(f)(7)(B), 7702A. Cash value is typically

accessed tax-free up to the tax basis via withdrawals, then accessed via loans, which are taxed as ordinary income but are not subject to capital gains. If the

life insurance policy lapses, loans and withdrawals that exceed the total premiums paid will become taxable.

4 If you are covered by a qualified retirement plan at work, traditional IRA contributions are fully deductible only if your adjusted gross income falls

within the following 2023 limits: single up to $73,000; married filing jointly up to $116,000. July 2023. Source IRS.gov. A distribution from a Roth IRA is

generally income tax free if (a) it meets all the requirements for a qualified distribution (which include a 5 year waiting period and one of several additional

requirements, one being that the distribution is made to a beneficiary on or after the death of the individual) or (b) it is a nonqualified distribution to the

extent of after-tax contributions (basis). See IRC Sec. 408A.

5 Generally interest paid on municipal bonds is tax-free, but not all municipal bonds are exempt from federal and/or state income tax. Some bonds may be subject to capital gains tax at sale. Consult a tax advisor for more information.

6 Mutual funds may be subject to income tax and /or capital gains tax. Consult your tax advisor fore more information.

7 For life insurance, contributions refers to life insurance premiums.

8 Source: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

9 There is not a specific limit on the dollars allocated to purchase life insurance; however, there are maximum premium limits determined by the policy's specified

6 of 9

Ethos Index Universal Life Insurance (IUL)

Built-in benefits and additional policy options

1. Ethos IUL comes with no-cost additional

benefits, or riders, that extend the power of your policy.

Access living benefits for qualifying conditions

According to the Centers for Disease Control, about 1 in 4 Americans face some type of disability1. To help ease the financial strain, the Care4Life Accelerated Death Benefit2 rider lets you access a percentage of your death benefit early for qualifying conditions:

• Critical illness: 25% of death benefit

• Chronic illness: 50% of death benefit

• Terminal illness: 75% of death benefit

Protect yourself from policy lapse & unintended taxes

If you borrow or withdraw from your cash value, the Overloan Protection Benefit helps to ensure that your policy doesn’t lapse, which would create a taxable event and loss of life insurance protection.

Secure a lifetime income stream

For a one-time activation fee, the Lifetime Income rider lets you use the cash value of your policy to create a guaranteed monthly income stream that lasts for the rest of your life.

Get free estate planning tools

A $449 value, the Ethos PERKS rider lets you create wills, trusts, power of attorney, health care directives and more. It also provides comprehensive estate and bereavement support for your loved ones. Not available in WA or SD.

2. Ethos IUL also offers optional riders at

an additional cost:

Waive premiums if you become disabled

The Waiver of Specified Premium rider helps protect your policy from lapsing by waiving your premium payments during a qualified disability.

Increase your death benefit in case of accident

The Accidental Death Benefit rider increases your death benefit if death is due to an accident.

1 Centers for Disease Control, Disability and Health Data System, 2021, updated 5/23 2 Based on your health when you apply, we may offer the Terminal Illness rider

instead, which allows early access to 75% of the death benefit for qualifying terminal

health conditions.

7 of 9

Ethos and Ameritas: Speed and strength

Ameritas is a mutual-based company owned by its policyholders, not shareholders. This enables a focus on long-term financial strength. Since its founding in 1887, Ameritas has delivered on its financial promises, and currently enjoys top ratings for financial strength from the industry’s most trusted ratings agencies.

A+ (Strong) | Standard & Poor’s Global (2/23)1 A (Excellent) | AM Best (5/22)2

Ethos is a technology company dedicated to bringing

protection to millions of families with fast, online life

insurance coverage. We’ve partnered with Ameritas Life

Insurance Corp. to provide the benefits of index universal

life through our simple application process.

How it works

1.

Apply with your agent – just answer a few health questions.

Review your coverage offer and policy illustration.

Activate your policy instantly with your

first payment.

2. 3.